⛅ Good morning. The S&P 500 enters the post–July Fourth stretch with fireworks of its own closing at a record high as retail investors pour in at historic levels. But the mood this morning is more cautious.

Futures are down as tariff tensions flare up again and job data stirs rate-cut bets. Musk launched a new political party (yes, really), Datadog popped on S&P 500 inclusion, and Avis is quietly ripping as hedge funds pile in.

⏩ Here’s everything you need to know to start your trading day sharp.

📊 MARKETS

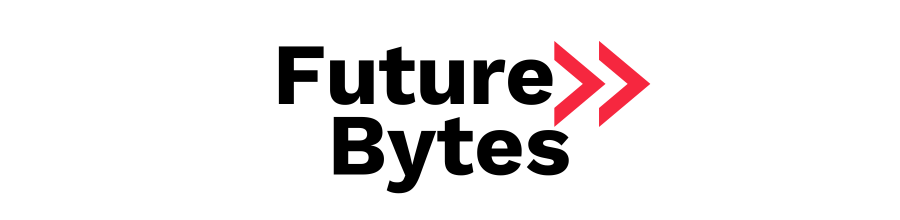

*Stock data as of market close, cryptocurrency data as of 5:00pm ET.

Markets: The S&P 500 heads into the post–July 4th stretch at a record high, rallying Thursday on the back of a strong monthly jobs report (markets were closed Friday). Retail investors are fueling the surge—they’ve poured a record $155 billion into U.S. stocks and ETFs in 2025, outpacing even the meme-stock craze of 2021, per VandaTrack. That wave of cash has lifted retail darlings like Avis, which has seen its shares take off.

Quick question…

🆕 What Do You Think of Our New Look?

📈 PRE- MARKET REPORT

Markets

U.S. futures are softer ahead of the open: Dow –0.07%, S&P –0.3%, Nasdaq –0.5%, as investors digest renewed tariff risk and mixed labor data from the start of the week .

⚠️ Macro & Trade

Tariff Risk Returns. U.S. officials confirmed the pause on reciprocal tariffs expires July 9, with renewed duties targeting Japan, EU, and India starting August 1 .

Fed Rate-Cut Odds Rise Post-ADP. The June ADP payrolls report revealed a –33K decline in private jobs, boosting rate-cut expectations. July cuts now seen as ~63% likely, with September fully priced in

🏛️ Macro Fundamentals

Futures & Rates Recap. Treasury yields softened as bond markets priced in weaker jobs dynamics. Dollar slid near multi-year lows, adding pressure on non-U.S. earners

🏭 Commodities

Oil slumped amid global growth concerns.

Gold gained support on safe-haven flows.

AI (Sponsored)

Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI

⚡QUICK BYTES

🚗 Tesla slides after Musk political pivot. TSLA sank ~6.7% pre-market after Elon Musk announced the formation of a new “America Party,” stoking investor concerns over distracted leadership and delivery drops.

🔐 Datadog surges on S&P 500 addition. Cloud analytics firm DDOG popped ~15% after news of being included in the S&P 500 triggering index fund inflows.

🤝 Capgemini to acquire WNS for $3.3B. The M&A deal boosted WNS shares ~14% on expectations of efficiency gains from the outsourcing consolidation .

⚖️ Futures wobble amid tariff uncertainty. U.S. futures slipped on ambiguity around proposed tariffs up to 70% targeting BRICS-aligned countries spooking markets

🛢 Oil prices tumble on OPEC+ production bump. OPEC+ announced a 548k bpd output boost for August, weakening crude prices (~3%).

📈 Nvidia's market cap nears $4T. Despite the broader market dip, NVDA held steady, closing just below the historic $4 trillion mark .

💰 MARKET MOVES

🔹 Regencell Bioscience (RGC) +7.9% pre‑market: The biotech stock jumped on speculation around upcoming trial data or potential M&A interest, marking it one of today's hottest pre-market performers.

🔹 Rocket Lab (RKLB) +3.3% pre‑market: The space-tech firm rallied after a strong earnings beat and announced new satellite deployment contracts.

🔹 Circle Internet (CRCL) +2% pre‑market: Still riding momentum after the recent S&P 500 ETF spike and positive traction around stablecoin regulation.

🔹Webull Corp (BULL) –8.4% pre‑market: The trading app’s stock tumbled, likely due to heavy insider selling and broader market rotation away from high-beta platforms.

🔹 Shell (SHEL) –3% pre‑market: Energy giant fell as analysts flagged disappointing gas-trading earnings in volatile markets.

🔹Oracle (ORCL) – slightly down pre‑market: The software firm trimmed prices on U.S. government contracts, sparking investor caution.

🔹Apple (AAPL) – modest dip: Shares eased despite better-than-expected iPhone sales in China; Huawei still maintains dominance.

🧠 DEEP DIVE

Consumer Discretionary

🚗 Avis Pops on Hedge Fund Buying and Travel Strength

Image source: Avis

Avis Budget Group (CAR) gained 2.12% to close at $181.31 on Monday after hedge fund Pentwater Capital revealed it had tripled its position in the rental-car giant, citing confidence in travel trends and vehicle pricing strength.

The stock recently hit a 52-week high, driven by optimism around summer travel, fleet efficiency gains, and supportive pricing for used vehicles—a key valuation lever for rental companies.

While Q1 results showed a deep EPS miss and negative EBITDA, management struck a bullish tone, highlighting early signs of a recovery and progress in rotating the fleet toward more fuel-efficient models.

Wall Street remains divided: JPMorgan upgraded the stock to Overweight with a $155 price target, while Goldman Sachs maintained a bearish stance, cutting its target to $87.

Still, CAR has climbed nearly 10% in the last two weeks, as institutional buying and technical breakout signals continue to draw momentum traders.

Big Data & AI

🚀 Palantir Rallies as AI Demand and Forecast Upgrades Fuel Momentum

Image source: The Economic Times

Palantir Technologies (PLTR) rose 1.66% to close at $134.36 on Monday, continuing a rally sparked by a strong Q2 earnings beat and fresh analyst praise from Zacks.

The company posted $0.10 in EPS versus $0.09 expected, alongside accelerating demand across its AI-driven government and commercial platforms. Zacks named PLTR a top growth pick, citing the company’s expanding deal pipeline and increasing enterprise adoption.

Momentum has been building for weeks, with the stock pushing through key resistance levels and drawing attention from institutional buyers betting on AI infrastructure growth.

Analysts remain bullish, highlighting Palantir’s unique positioning at the intersection of defense, government data, and enterprise AI. Several raised their FY2025 revenue estimates to reflect growing global demand for secure, large-scale analytics platforms.

Palantir shares are up more than 20% over the past month and are now trading just above a key breakout zone near $134.

Semiconductors

📈 Broadcom Climbs as AI Chip Demand Powers Solid Q2 Beat

Image source: Reuters

Broadcom (AVGO) climbed 1.92% to close at $275.18 on Monday after reporting strong Q2 results and gaining attention from Zacks as a top AI chip play.

The chipmaker posted earnings of $1.58 per share on $15 billion in revenue—both beating expectations—driven by robust demand for data center and AI infrastructure chips. Analysts praised the company’s diversified exposure, which spans semiconductors, enterprise software, and cloud networking.

Broadcom has increasingly positioned itself as a defensive leader in the AI boom, with its VMware integration expanding its reach across hybrid cloud and edge workloads.

Zacks upgraded the stock to a “Strong Buy,” and several Wall Street firms followed with bullish notes, pointing to stable earnings growth even in a choppy macro environment.

AVGO is up roughly 18% year-to-date and is now sitting comfortably above its 50-day moving average, with new support forming near $270.

🛠️ TOOLS YOU CAN USE

📊 Shortcut - AI agent for Excel data tasks

💎 Gems - Custom AI experts for Gemini, now available across Google Suite

🎨 Soul Inpaint - Higgsfield AI’s new image editing tool for precise changes

🗣️ Kyutai TTS - Open-source text-to-speech model for real-time use

AI (Sponsored)

Learn AI in 5 minutes a day

What’s the secret to staying ahead of the curve in the world of AI? Information. Luckily, you can join 1,000,000+ early adopters reading The Rundown AI — the free newsletter that makes you smarter on AI with just a 5-minute read per day.

That’s it for today!

We’ll be back tomorrow with pre-market movers, sector shakeups, and the next market catalysts.

—The Future Bytes Team

P.S. You can unsubscribe anytime. But we hope you don’t.

This newsletter is free (for early subscribers). Enjoy!

Forwarded by a friend? Sign up with just one click here.

P.S. Make sure to whitelist our email address to ensure you never miss an update from us.