⛅ Good morning. The market just wrapped Q2 with fireworks 🎇, and not the Fourth of July kind ;). Stocks closed the quarter at all-time highs, led by tech, trade optimism, and a quietly crumbling dollar.

The S&P 500 notched its best quarterly run since late 2023, while Meta and Oracle both climbed to fresh records. As we enter a new quarter, the key question: how long can this rally run?

📊 MARKETS

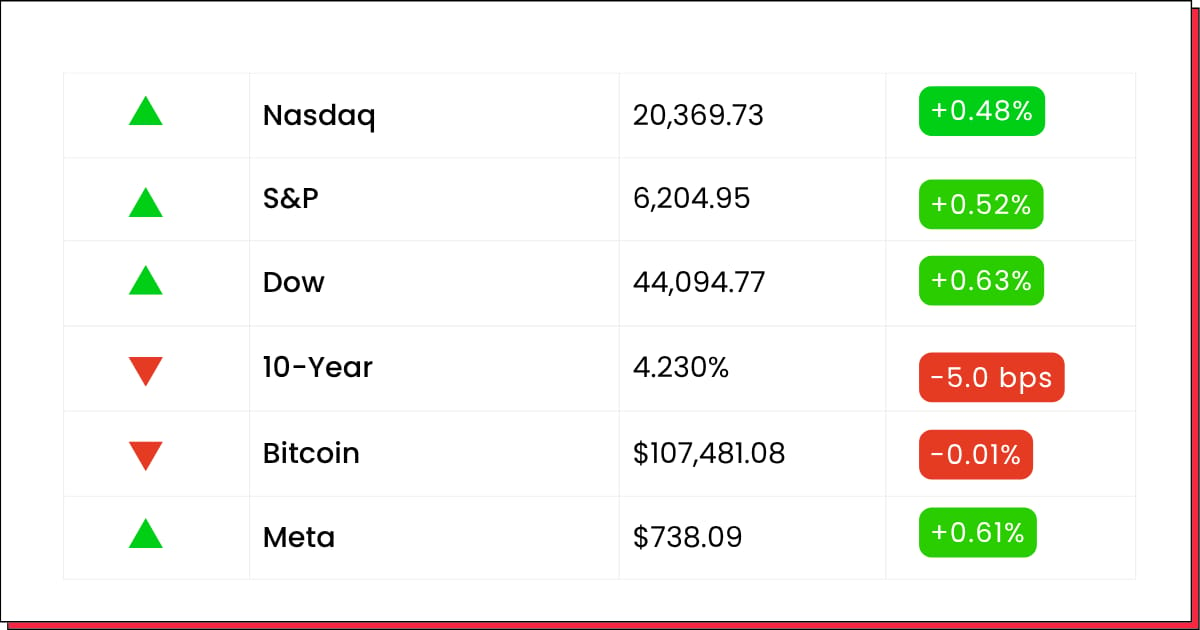

*Stock data as of market close, cryptocurrency data as of 5:00pm ET.

Markets: The week may be short, but stocks rallied hard. The S&P 500 closed at a new record, marking its best quarter since December 2023. Meta also reached an all-time high as Zuckerberg continues his aggressive AI hiring push.

📈 PRE- MARKET REPORT

Market Recap

The S&P 500 closed Q2 at 6,204.95, marking a 0.5% gain on June 30 and a full 10.6% increase for the quarter—the strongest since late 2023. Nasdaq also ended June at an all-time closing high of 20,369.73, up 0.5% on the day, while the Dow advanced 0.6% to 44,094.77 .

Key drivers:

Eased trade tensions as Canada shelved its digital-services tax and resumed talks with the U.S.

Looming July 9 tariff deadline continues to stir market debate

Dollar slumped for a sixth straight month; euro rose to a nearly four-year high

Fed rate-cut bets gained traction as President Trump pressed Powell on easing

Financials

Large-cap banks gained traction as the Fed’s stress tests affirmed their capital strength. This boost contributed to a record close for the Financials sector index

Tactical Note:

The rally offers an opportunity to rotate gains from tech into banks.

Watch firmer entries near 21-day MA; potential for short-term upside if yield curve steepening continues.

Tech & AI

Tech sector’s rise came from sustained AI optimism, yet trade risks and policy issues persist. The dollar’s weakness and IBM growth trends continue to support the narrative .

Tactical Note:

Consider adding to top-tier AI-linked names on pullbacks.

Use tight stops; macro headlines—including the Senate vote or tariff deadlines—can provoke abrupt shifts.

Sector Rotation

Industrials and materials saw inflows as momentum broadened beyond mega-caps. Renewable energy stocks, including First Solar, surged on supportive Senate bill signings

Tactical Note:

Position for a rotation into cyclical sectors—watch base metals and DEFNs for entry opportunities.

A defensive tilt into utilities or gold miners may help hedge against any policy shock.

🧠 DEEP DIVE

Electric Vehicles

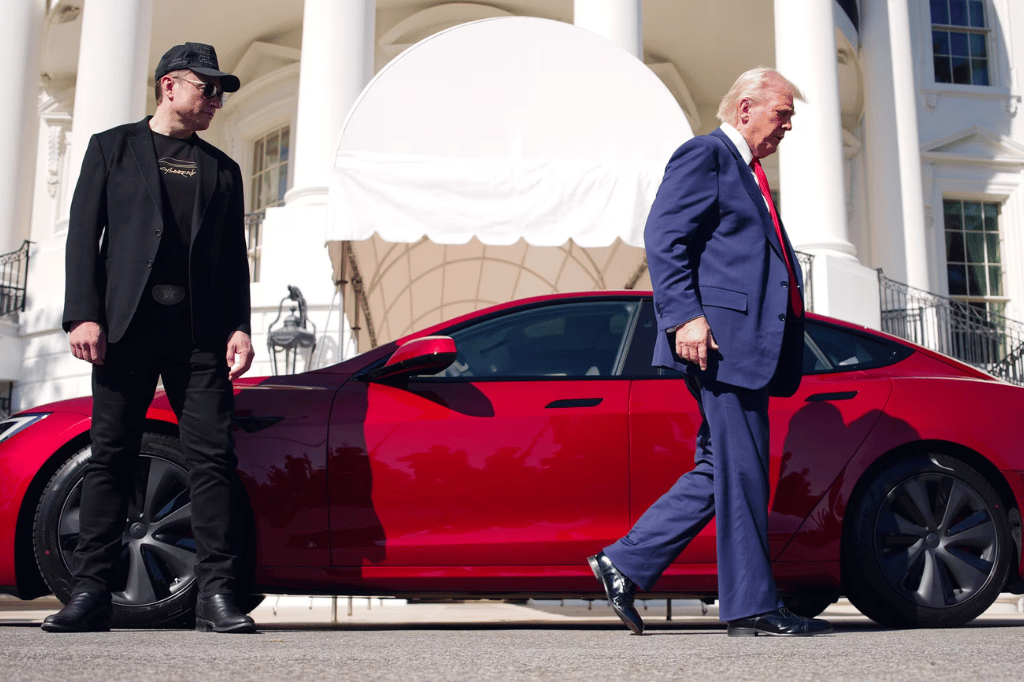

🔋 Tesla Slips as Musk Clashes with Trump Over EV Subsidies

Image source: Automotive News

Tesla (TSLA) edged down 0.02% to close at $317.66 on Tuesday, following a tense public exchange between CEO Elon Musk and President Trump over federal EV subsidies.

The decline caps a rough stretch for the EV maker, which is also grappling with softening demand in Europe. Deliveries in Sweden and Denmark declined for a sixth straight month, raising questions about Tesla’s international momentum.

While Tesla remains aggressive in expanding its AI capabilities—particularly through its Dojo training platform—investors appear increasingly wary of political uncertainty and near-term margin pressure.

Analysts at Wedbush and Morgan Stanley reiterated long-term bullish views, citing strong positioning in autonomous software and next-gen battery tech, but acknowledged headline risk could limit upside in the near term.

Tesla shares are down more than 12% over the past month, currently trading near a key technical support zone at $317.

Semiconductors

📦 Nvidia Stalls After 7-Day Rally Amid Export Concerns

Image source: The Economic Times

Nvidia (NVDA) slipped 0.1% to $157.99 on Tuesday, ending a seven-day winning streak as investors reacted to renewed concerns about potential U.S. restrictions on chip exports to China.

The semiconductor giant has surged this year on the back of strong AI demand and record-breaking data center growth, but regulatory headwinds continue to pose short-term risks to its global business.

Recent speculation around expanded export controls—particularly for high-end GPUs used in AI training—has added uncertainty just as Nvidia solidifies its leadership in the space.

Still, the dip is seen by many analysts as a healthy breather after a sharp run-up. Jefferies and Evercore both issued notes calling the pullback a “buy-the-dip” opportunity, citing a robust pipeline of hyperscaler orders.

Nvidia remains up more than 70% year-to-date and is currently trading just below its recent highs.

Enterprise Software

☁ Oracle Climbs to Record High on Massive Cloud Deal

Image source: MSN

Oracle (ORCL) rose 4% to $218.63 on Tuesday, extending gains after unveiling a multibillion-dollar cloud contract projected to generate over $30 billion in revenue by FY2028.

The deal positions Oracle as a major player in next-gen enterprise infrastructure, with analysts praising its Gen2 Cloud momentum and growing AI compute capabilities.

Management emphasized the strategic nature of the agreement, noting that it significantly boosts visibility into recurring revenues and will help accelerate margin expansion through 2026.

In response, firms like Stifel, JPMorgan, and UBS raised their price targets, with the consensus now ranging between $240 and $260.

Oracle shares are now up over 30% year-to-date and sit at an all-time high, cementing its position as one of the strongest enterprise software performers of 2025.

🧩 EVERYTHING ELSE

🛡️ Cloudflare moves to block AI model scraping without user consent, signaling a broader crackdown on unauthorized data use.

⚠️ Tesla faces analyst warnings as delivery numbers may fall short, with attention shifting toward its upcoming robotaxi plans.

🧠 Microsoft’s AI chief highlights the next wave of AI as a potential game-changer in healthcare diagnostics.

📉 Goldman Sachs pulls forward its rate cut forecast to September amid signs of a cooling economy.

✈️ SAS places an order for 45 new Embraer jets to strengthen regional air connectivity across the Nordics.

💊 Novo Nordisk faces backlash in the U.S. after underestimating demand for its high-profile weight-loss drug.

🤖 Amazon CEO forecasts that AI will significantly transform the workforce by eliminating repetitive tasks.

💰 MARKET MOVES

🔹Tesla (TSLA): –4.1% pre‑market. Shares dropped after CEO and Trump locked horns over the new tax-and-spending plan, reigniting policy uncertainty around EV subsidies and triggering a sixth monthly dip in European EV sales

🔹 Robinhood Markets (HOOD): +3.1% pre‑market. Robinhood climbed as it prepares to roll out expanded crypto trading services in the U.S. and Europe—building off its Q2 momentum with a stunning YTD surge

🔹 Circle Internet (CRCL): +1.1% pre‑market. The stablecoin issuer edged up after applying to establish a national trust bank, a move that hints at broader ambitions in the regulated financial landscape

🔹 AeroVironment (AVAV): –5.5% pre‑market. Drone-maker shares tumbled amid broader market retreat in futures, weighed down by tech and defense pullbacks tied to geopolitical and cost concerns

🔹 Las Vegas Sands (LVS): +4.3% pre‑market. The casino operator surged as futures weak momentum lifted leisure and travel names, and investor sentiment shifted toward reopening and consumer play

🛠️ TOOLS YOU CAN USE

🧠 Hunyuan-A13B. Tencent’s new open-source hybrid reasoning model

🎇 Qwen VLo. Alibaba’s 4o-style model for image generation and editing

🎼 Songscription. Turning audio clips instantly into sheet music

🍎 NotebookLM. Now available via Gemini in Classroom for educators

And that’s a wrap for today. Q3 is here, and markets are already off to the races.

We’ll keep tracking the major headlines, from rate cut whispers to robotaxi drama.

Same time tomorrow,

—The Future Bytes Team

P.S. You can unsubscribe anytime. But we hope you don’t.

This newsletter is free (for early subscribers). Enjoy!

Forwarded by a friend? Sign up with just one click here.

P.S. Make sure to whitelist our email address to ensure you never miss an update from us.