⛅ Good morning and happy Monday! Earnings season is back and markets are already feeling the pressure.

Futures are sliding as Trump reignites tariff tensions, warning of 30% duties on EU and Mexican imports starting August 1. Meanwhile, Wall Street braces for CPI, PPI, and some of the biggest Q2 reports of the year.

Here’s what you need to know before the opening bell. 👇

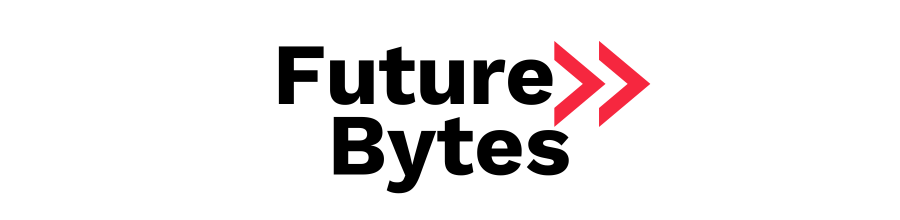

📊 MARKETS

*Stock data as of market close, cryptocurrency data as of 1:00am ET.

Markets: Wall Street kicks off earnings season after all three major indexes slipped slightly last week. But some argue the drop should’ve been steeper, voices like JPMorgan CEO Jamie Dimon warn that markets are brushing off the risks of Trump’s renewed tariff threats, which could hit the economy harder than investors expect.

📈 PRE- MARKET REPORT

Markets

📉 Futures dip amid tariff tensions

U.S. index futures slipped ~0.3% following President Trump’s announcement of 30% tariffs on EU and Mexican imports starting August 1 a move that rattled markets ahead of key economic data this week.

📈 Hot Premarket Movers

Boeing (BA) +2%: Climbed after Indian investigators reported no design flaws in the Air India crash, putting focus on fuel valve issues .

Fastenal (FAST) +3%: Strengthened following Q2 results that beat expectations, pointing to resilient industrial demand

Tesla (TSLA) edged higher after announcing a shareholder vote on allocating investment to Elon Musk’s xAI venture .

Alphabet (GOOGL) –0.6%: Dropped after agreeing to pay $2.4B to license AI tech from startup Windsurf and recruit its CEO .

Kraft Heinz (KHC) +1%: Gained on reports that it may spin off its grocery unit, tapping into potential value unlock

🪙 Crypto stocks on the rise:

MicroStrategy (MSTR) +2.5%

Coinbase (COIN) +1.5%

Robinhood (HOOD) +2.3%

Riot Platforms (RIOT) +3.1% rebounding as Bitcoin reclaimed $121K, boosting miner sentiment

Marathon Digital (MARA) +2.7% tracking Bitcoin’s surge, alongside rising hash rate capacity

CleanSpark (CLSK) +2.2% lifted by improved mining margins and bullish retail flows

🔭 What to Watch Next

Event | Date |

|---|---|

CPI (Consumer Price Index) | Tuesday |

PPI (Producer Price Index) | Wednesday |

Key Q2 earnings: JPMorgan, BofA, Morgan Stanley, Netflix, PepsiCo, J&J, and ASML | Throughout week |

Economic Outlook (Ad)

Something huge is headed to America's shores – and it scares the hell out of Wall St. legend Louis Navellier. When it makes landfall, its impact will be more violent and more severe than any financial crisis we've ever seen… "No matter how prepared you think you are, you aren't prepared enough," he warns.

⚡QUICK BYTES

🔼 Synopsys (SNPS) received conditional approval from Chinese regulators for its $35 billion merger with Ansys, clearing the last major hurdle for the deal—a strong structural positive for the EDA sector. Shares rose ~3% pre-market

📉 Macy’s (M) announced a proposed senior notes offering, indicating funding efforts likely tied to strategic repositioning or growth initiatives .

🔒 Enerflex (EFX) (energy infrastructure provider) extended its revolving credit facility ahead of Q2 results, a preparatory move often seen ahead of earnings or capex increase announcements .

⚡ Par Pacific (PARR) saw shares rally ~12% last week after a raised price target, signaling increased investor optimism in midstream energy assets

🔥 PBF Energy (PBF) surged nearly 18% over the week following bullish sentiment around refining margins—a standout in the energy sector .

💰 MARKET MOVES

🔹 Stardust Power Inc. (SDST) +62% pre-market. A massive spike driven by speculative interest and high volume (~64M shares) after strong chatter in social-media investing circles

🔹 Sonnet BioTherapeutics (SONN) +266% pre-market. A biotech surge—triple-digit gains—likely tied to phase trial data or FDA commentary

🔹 Presidio Property Trust (SQFT) +187% pre-market. REIT enthusiasm sparked a rally following an analyst upgrade and news of a strategic merger announcement

🔹 OceanPal Inc. (OP) +62% pre-market. Another speculative pump in small-cap shipping equity—volumes surged over 22M shares

🔹 BIT Mining (BTCM) +31% pre-market. Crypto-linked miner popped as Bitcoin neared $123K—momentum rippling through the sector

🧠 DEEP DIVE

Automotive

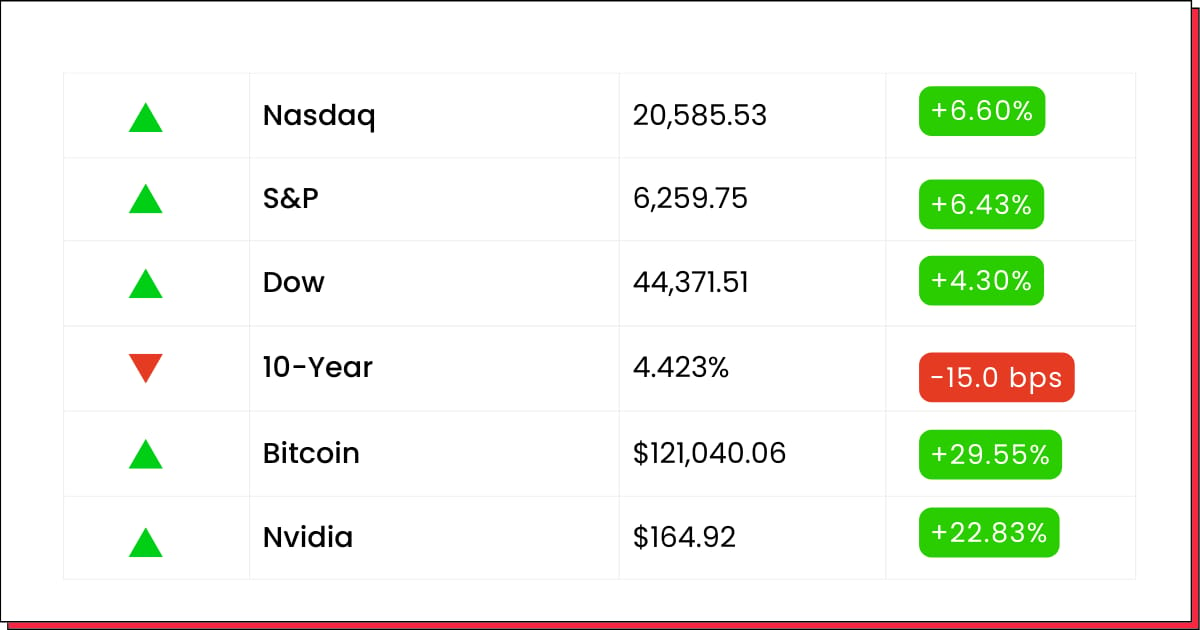

🚘 Toyota Dips Slightly Despite $70B EV Investment Push

Image source: CNBC

Toyota Motor (TM) edged down 0.04% to close at $170.26 on Monday after the company announced a massive ¥8 trillion (~$70 billion) investment in battery-electric vehicles by 2030—a move aimed at cementing its role in the global EV transition.

The spending plan will fund the development of 30 new EV models and bolster Toyota's competitive stance as import tariffs on EU and Mexican vehicles loom. Investors view the move as a long-overdue shift from ICE (internal combustion engine) dependence.

While near-term margin pressure is likely as R&D costs rise, the long-term strategic shift is expected to open new market share in North America and Asia.

Wall Street reaction has been cautiously optimistic, with several analysts suggesting tactical buys near the $165–168 level as the EV plan unfolds.

Aerospace

✈️ Boeing Gains After India Crash Probe Eases Design Fears

Image source: Reuters

Boeing (BA) rose 0.32% to close at $226.84 on Monday after Indian aviation authorities said a recent Air India crash was linked to a fuel cutoff switch, not a structural flaw in the aircraft—helping restore confidence in Boeing’s plane design.

The news sparked a modest relief rally, with investors welcoming the avoidance of more costly redesigns or delivery delays. Analysts noted the outcome removes a potential cloud ahead of several major delivery reviews this quarter.

Technically, Boeing is now attempting to stabilize above the $220–225 range, with possible upside retests near $240–255 if further inspections confirm the initial findings.

The stock remains down for the year but may regain altitude if clarity continues and earnings surprise to the upside.

Industrials

🔧 Fastenal Steady After Q2 Beat Signals U.S. Manufacturing Strength

Image source: Reuters

Fastenal (FAST) slipped 0.65% to close at $43.27 on Monday despite posting a Q2 earnings beat, driven by a 6.1% YoY jump in average daily sales and reaffirmed full-year guidance amid steady demand from U.S. manufacturers.

The company’s expanding digital footprint—now accounting for over 62% of revenue—boosted operational efficiency and improved margin visibility. Management highlighted strong momentum in its industrial vending and logistics services.

While inflationary pressures remain a concern, the stock is being viewed as a bellwether for broader industrial resilience.

Traders are watching for a technical floor near $41–42, with potential upside to $48–50 if macro data continues to support the sector’s rebound.

Political Market Moves (Ad)

Forget about AI… There's a hot new trend on Wall Street… and it's all thanks to President Trump. His administration has begun to fast-track the operations of a handful of companies… Accelerating their potential profits. That's why legendary investor Louis Navellier is now recommending these three stocks that are being fast-tracked.

🛠️ TOOLS YOU CAN USE

🧠 Grok 4 - xAI’s latest SOTA model

🖥️ Comet - Perplexity’s new AI-first browser

🤖 Reachy Mini - Hugging Face’s open-source AI robot companion

🏥 MedGemma - Google's open models for health AI development

That’s a wrap for this morning’s issue.

With earnings rolling in, inflation prints on deck, and trade policy back in focus, expect volatility to pick up fast.

We'll be back tomorrow with the biggest movers, key setups, and under-the-radar names catching fire.

—The Future Bytes Team

P.S. You can unsubscribe anytime. But we hope you don’t.

This newsletter is free (for early subscribers). Enjoy!

Forwarded by a friend? Sign up with just one click here.

P.S. Make sure to whitelist our email address to ensure you never miss an update from us.