👋 Good afternoon. U.S. stocks defied tariff jitters and nudged higher Monday, with the Nasdaq closing at a new record and traders bracing for a week packed with CPI, PPI, and retail data.

While Trump’s trade threats dominated headlines, investors zeroed in on Q2 earnings, AI, and crypto momentum. Orange juice futures stole the commodity spotlight (yes, really), and Palantir soared to new highs as AI euphoria powered tech.

Let’s break down everything that mattered today, without the fluff. 👇

📊 MARKETS

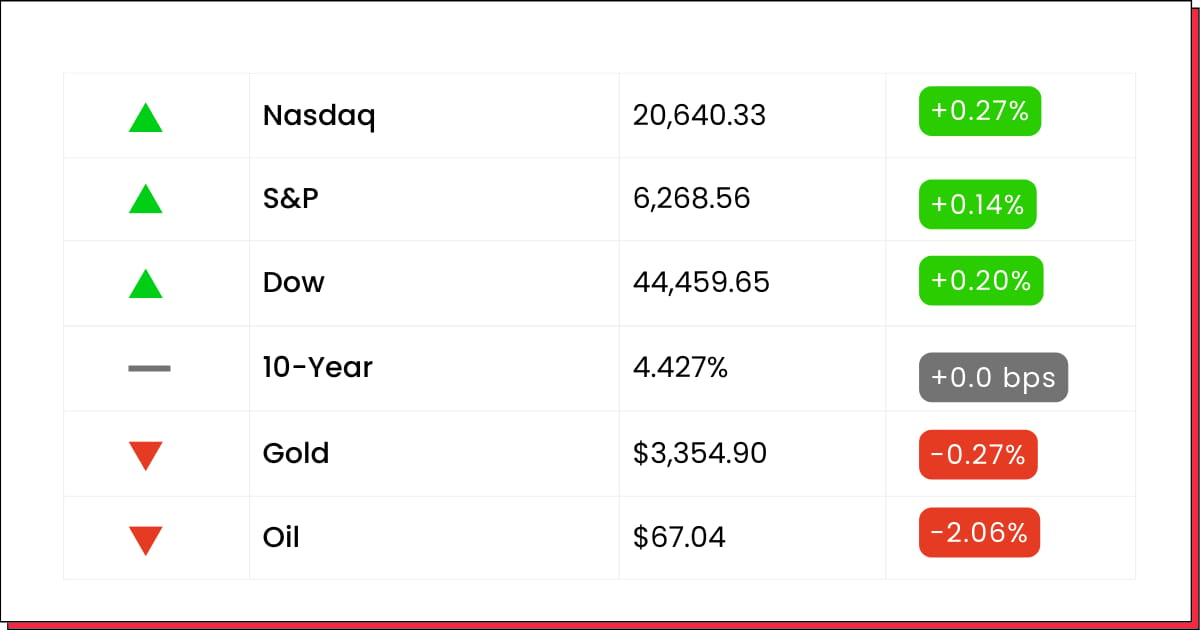

*Stock data as of market close":

Markets: U.S. stocks brushed off President Trump’s tariff threats—30% on the EU and Mexico and 100% on Russian goods—as investors stayed focused on earnings momentum. The Nasdaq hit a fresh record close, while broader indexes posted modest gains across the board.

Commodities: Oil slipped and gold cooled off, but orange juice futures surged to a four-month high after Trump pledged 50% tariffs on all Brazilian imports. ☕ Coffee prices also climbed.

⚡ QUICK BYTES

📊 Stocks end flat as tariffs loom. Wall Street treads water after President Trump announced 30% tariffs on EU and Mexican imports, while investors await Q2 earnings, CPI, PPI, and retail sales this week

🚀 Palantir hits fresh record. Palantir Technologies pushed to a new all-time high on continued AI-driven momentum, outpacing other S&P 500 leaders

🛡️ Market shrug despite trade threats. Despite threats ranging from 30% tariffs on Mexico/EU to possible 100% on Russia-related trade.

🪙 Crypto surge amid ‘Crypto Week’. Bitcoin reclaimed highs above $121K–123K, fueling gains in Coinbase, MicroStrategy, Bitfarms, and Riot as Washington takes the spotlight for crypto regulation .

🧠 DEEP DIVE

AI Infrastructure

☁ Nebius Surges as Goldman Calls It a “Top Pick” for AI Cloud

Image source: Forbes

Nebius Group (NBIS) soared 17.1% to close at $51.89 on Monday after Goldman Sachs initiated coverage with a Buy rating and a $68 price target, citing strong positioning in the fast-growing AI infrastructure space.

The Nvidia-backed firm—spun out from Yandex—has aggressively scaled its data center footprint across the U.S. and Europe, benefiting from enterprise demand for high-performance AI compute. Analysts highlighted its exclusive access to Nvidia Blackwell GPUs and a projected $1B ARR run rate by year-end as major catalysts.

The call from Goldman followed recent bullish upgrades from DA Davidson and Piper Sandler, all painting Nebius as a rising neocloud player capable of taking market share from legacy providers.

NBIS shares have now climbed nearly 60% over the last six weeks and are approaching resistance around the $54–$55 zone. Execution risk remains, but sentiment is clearly leaning bullish as institutional inflows accelerate.

Political Market Moves

Forget about AI… There's a hot new trend on Wall Street… and it's all thanks to President Trump. His administration has begun to fast-track the operations of a handful of companies… Accelerating their potential profits. That's why legendary investor Louis Navellier is now recommending these three stocks that are being fast-tracked.

Software & AI

📈 Autodesk Pops as PTC Merger Talks Collapse, AI Focus Strengthens

Image source: Autodesk

Autodesk (ADSK) surged 5.35% to close at $294.20 on Monday after confirming it had ended merger discussions with PTC, with analysts and investors applauding the move as a reaffirmation of its standalone strategy.

The architecture and design software leader is now redirecting focus toward its internal GenAI roadmap, which analysts believe could deliver faster, more efficient automation across construction and engineering workflows.

The breakup was well-received, seen as avoiding costly integration and keeping capital deployment focused on organic growth and buybacks. Activist investor Starboard Capital is reportedly pressing for tighter cost discipline.

ADSK stock is now up nearly 20% from its June lows and nearing resistance in the $300–$310 range. Analysts have started to revise price targets upward on improved margin visibility and AI adoption tailwinds.

Digital Payments

💸 PayPal Rises on Q2 Beat, Leans Into AI and Crypto Features

Image source: IronFx

PayPal (PYPL) gained 3.38% to close at $73.77 on Monday, lifted by stronger-than-expected Q2 earnings and early AI innovation efforts aimed at boosting competitiveness.

The fintech firm reported a rebound in volume through Braintree and Venmo, and introduced pilots for AI-driven fraud detection and real-time crypto conversion tools—signaling a deeper push into smart payments.

Trading at a forward P/E of ~14.2, analysts see the stock as undervalued given its evolving tech stack. The earnings beat helped push PYPL above a key breakout level near $72, reversing a multi-week downtrend.

Shares are now up 10% over the last three weeks, with bullish firms like Evercore and Raymond James projecting a return to YTD highs near $78 if product adoption trends continue.

Aerospace & Defense

🚀 Rocket Lab Climbs as Citi Hikes Price Target to $50

Image source: Entrepreneur

Rocket Lab (RKLB) rose 0.5% to close at $26.72 on Monday, marking its fifth green session in seven days after Citi raised its price target from $33 to $50 and reaffirmed a Buy rating.

The firm continues to gain investor confidence as its Neutron rocket nears its first commercial launch. Citi projects 20 Neutron flights by 2029, generating over $2.6 billion in revenue, while recent defense satellite contracts and the Geost acquisition add to the upside case.

With a reusable launch strategy and growing presence in national security missions, Rocket Lab is now seen as one of the most credible public competitors to SpaceX.

Shares have rallied over 600% year-to-date, currently trading just above key support at $26, with momentum traders eyeing a breakout toward the $30 mark if upcoming test milestones are met.

Economic Outlook

Something huge is headed to America's shores – and it scares the hell out of Wall St. legend Louis Navellier. When it makes landfall, its impact will be more violent and more severe than any financial crisis we've ever seen… "No matter how prepared you think you are, you aren't prepared enough," he warns.

📊 WINNERS & LOSERS

📈 Top Gainers

Boeing (BA) +1.6% — Ascended after India’s preliminary crash report cleared design flaws on the 787 Dreamliner. The relief boosted related suppliers like GE Aerospace, alleviating safety concerns and offering a cleaner outlook ahead of key defense contract announcements Morningstar +2 Yahoo Finance +2 YouTube +2 .

MicroStrategy (MSTR) +4% — Speared higher in lockstep with Bitcoin's rally above $123K, thanks to strong institutional ETF demand and renewed confidence in BTC as an institutional asset .

Thomson Reuters (TRI) +7.7% — Broke out to fresh all-time highs as Canadian markets celebrated strong performance in its fintech and data segments, hinting at potential inclusion in broader global indexes .

Fastenal (FAST) +4.2% — Gained momentum after delivering a positive Q2 beat: $2.08B in revenue and $0.29 EPS, signaling sustained demand in industrial supply chains .

📉 Notable Decliners

Waters Corp (WAT) −9.4% — Plummeted amid a $17.5B merger announcement with Becton Dickinson’s biosciences unit, igniting investor fears around dilution and protracted integration .

Synopsys (SNPS) −1.7% — Edged lower despite China approving its $35B acquisition of Ansys—investors shelved enthusiasm ahead of potential regulatory and integration hurdles .

Rivian (RIVN) −2.2% — Slipped after Guggenheim downgraded shares due to concerns over softer demand and production momentum, contributing to broader EV sector pressure .

Nvidia (NVDA) −0.5% — Saw a mild pullback ahead of CEO Jensen Huang's scheduled visit to Beijing, as investors weighed geopolitical and trade risk .

💡 That’s a wrap for today.

Markets are dancing between trade drama and tech optimism and we’ll be here every step of the way to decode it all for you.

See you at the opening bell tomorrow,

—The Future Bytes Team

This newsletter is free (for early subscribers). Enjoy!

Forwarded by a friend? Sign up with just one click here.

P.S. Make sure to whitelist our email address to ensure you never miss an update from us.