⛅ Good morning. It’s shaping up to be a pivotal day for markets. After a hotter-than-expected CPI print, investors are recalibrating rate expectations while Nvidia’s China chip comeback injected some serious optimism into the tech trade.

Financials are splitting post-earnings, chip stocks are swinging on mixed guidance, and we’ve got a jam-packed calendar from Fed speeches to the Beige Book.

Let’s break it all down. 👇

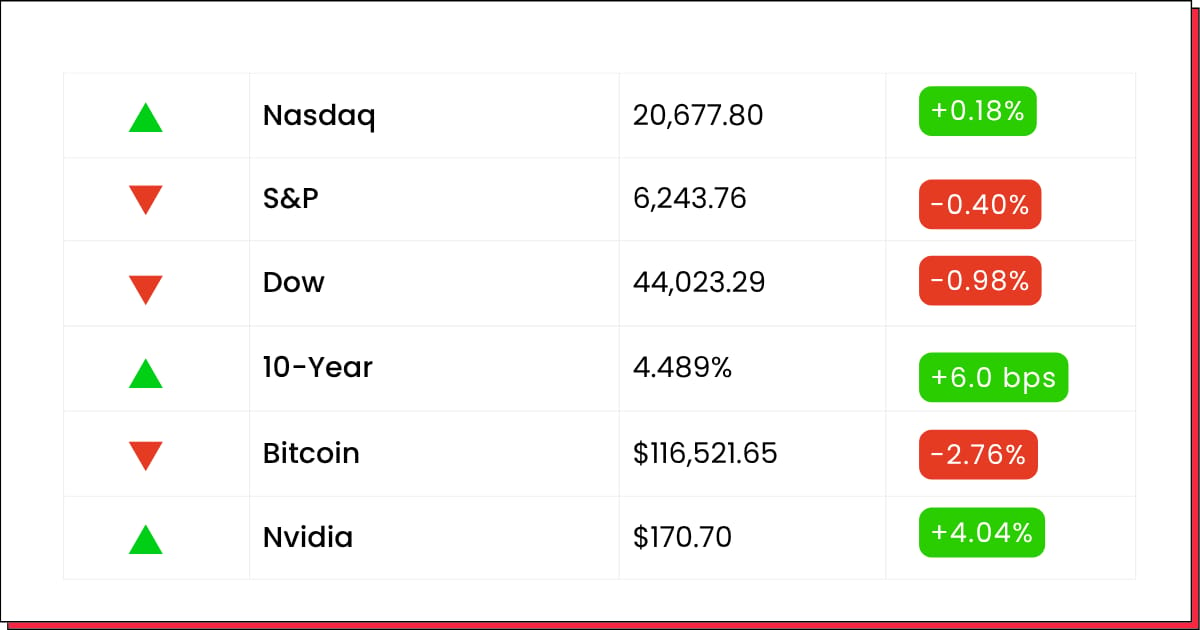

📊 MARKETS

*Stock data as of market close, cryptocurrency data as of 4:00pm ET

Markets: Stocks dipped yesterday after inflation data showed prices creeping higher—but the Nasdaq brushed it off, lifted by Nvidia, which surged to a record close. Investors are buzzing over reports that the chip giant may soon resume semiconductor sales in China.

📈 PRE- MARKET REPORT

📊 Markets

U.S. futures are mixed: Nasdaq +0.6%, S&P +0.4%, Dow –0.1%, as investors digest yesterday’s CPI print and Nvidia’s revival in China chip sales .

Inflation linger: June CPI rose 0.3% MoM—the largest monthly gain since January stoking concerns about persistent price pressure and pushing Treasury yields higher .

Trade uncertainties remain: Trump’s tariff threats continue to weigh, though tech-led optimism is offsetting some of that bearish tone .

***

🔋 Pre‑Market Movers

Nvidia (NVDA) +4.5% pre‑market: Shares surged after news that H20 AI chips can resume exports to China. This catalyst followed yesterday’s ~5% gain post-announcement .

Applied Materials (AMAT) & AMD also gained slightly, riding the wave of upbeat sentiment across the semiconductor sector .

Bank Stocks Mixed: Citi rose ~4% after earnings beat; Wells Fargo fell ~5%, showing earnings divergence in the financial sector

***

🛡️ Asset Flows & Commodities

Gold is steady around $3,330/oz, as inflation concerns balance with risk sentiment .

10‑Year Treasury yield reached its highest level in a month following the CPI release .

Oil trades slightly lower (~$68.50/bbl) amid persistent trade fears

***

🔭 What to Watch Today

Event | Time (ET) |

|---|---|

Industrial Production & Capacity Utilization (G.17) | 9:15 a.m. |

Speech: Gov. Michael S. Barr (Financial Regulation) | 10:00 a.m. |

CP – Commercial Paper Data | 1:00 p.m. |

Beige Book | 2:00 p.m. |

Selected Interest Rates (H.15) | 4:15 p.m. |

PPI (Producer Price Index) | 8:30 a.m. |

Bank Earnings (Goldman Sachs, Morgan Stanley) | Pre-market |

Fed Speakers | All Day |

Tech & Trade (Sponsored)

In light of Trump's tariff announcements, it's time to forget outsourcing. This American chip maker is creating next-generation technology right here at home. Louis Navellier's system, which spotted NVIDIA early, shows this company's "Made in USA" advantage could deliver both economic growth and potentially explosive returns – despite the current volatility in the market

⚡QUICK BYTES

🇬🇧 UK inflation rises to 3.6%, turning up the heat on the Bank of England ahead of its next rate call.

⚖️ Facebook’s $8B privacy lawsuit heads to trial, with Zuckerberg in the hot seat over targeted ads.

🛠️ Rolls-Royce plans $200M expansion in South Carolina to boost aerospace engine component production.

📉 ASML sinks after warning sales growth could flatline next year, rattling chip investors.

🤝 Uber partners with Baidu to deploy autonomous vehicles internationally

💰 MARKET MOVES

🔹 Global Payments (GPN) +6.1% pre‑market: Shares surged after reports that activist hedge fund Elliott Management took a significant stake—a classic catalyst for M&A or board shakeups .

🔹 Icahn Enterprises (IEP) +7.0% pre‑market: The company jumped after Carl Icahn’s fund hinted at a new activist campaign, sparking speculation around potential breakup or asset sales

🔹 Nvidia (NVDA) –0.2% pre‑market: The AI powerhouse cooled down slightly after yesterday’s 4% surge on China chip news, but remains near cycle highs

🔹 Bank of America (BAC) +1.4% pre‑market: Financials continue to hum—BAC rose following strong Q2 earnings and trading revenue upgrades

🔹ASML Holding (ASML), Applied Materials (AMAT), Lam Research (LRCX), KLA (KLAC) –2% to –3% pre‑market: The chip-equipment group weakens after ASML issued cautionary guidance on 2026 growth, raising concerns over emerging tariffs

🧠 DEEP DIVE

Semiconductors

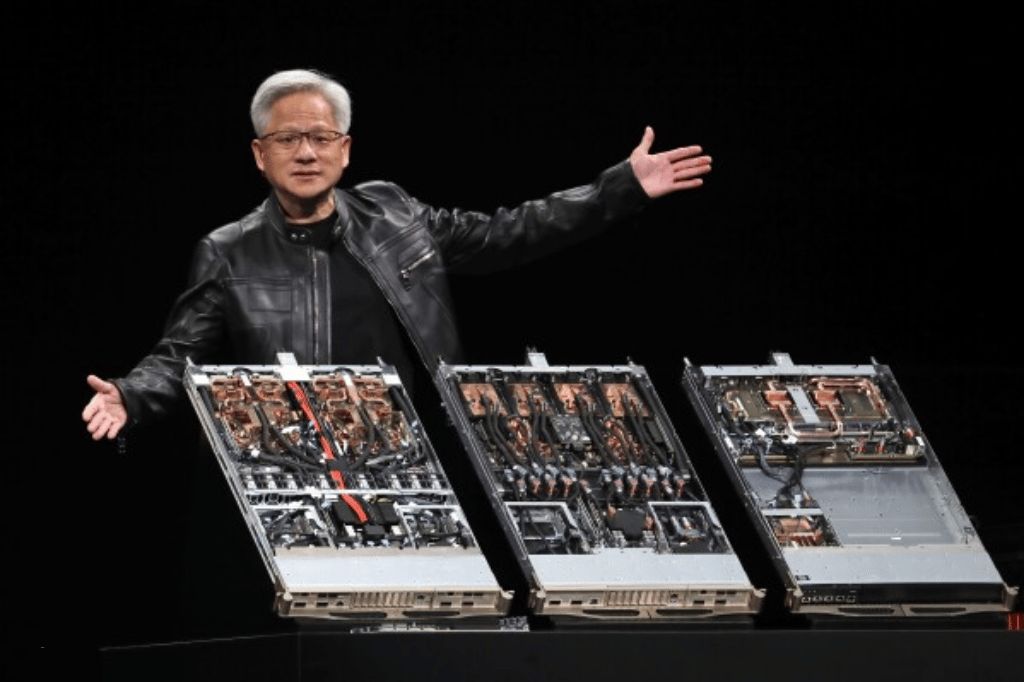

💥 Nvidia Pops as China Greenlights H20 AI Chip Sales

Image source: AP News

Nvidia (NVDA) jumped 4.02% to close at $170.70 on Tuesday after news broke that China would resume purchases of its H20 AI chips, a major reversal of earlier export curbs that had pressured the semiconductor giant.

The rally sent the Nasdaq to fresh highs, as traders bet on Nvidia’s renewed access to the Chinese hyperscaler market. ByteDance, Tencent, and Baidu are reportedly preparing large-scale orders, signaling a rebound in demand for high-performance training chips.

The rebound adds to Nvidia’s dominant run in the AI boom. Analysts say resumed shipments to China could restore up to $20 billion in annual sales while a softer dollar boosts margin outlooks abroad.

Nvidia shares are now up 75% year-to-date and pushing toward key resistance near $180, with dip buyers eyeing the $165–168 zone as potential entry.

Advertising Technology

🚀 Trade Desk Soars on S&P 500 Inclusion

Image source: Investopedia

The Trade Desk (TTD) surged 15.2% to close at $80.40 on Tuesday after S&P Dow Jones announced the ad-tech firm will join the S&P 500, replacing Ansys in the benchmark index.

The inclusion sparked massive inflows from index funds and ETFs, sending after-hours volume soaring. TTD has outperformed peers in 2025, driven by strong CTV ad growth and AI-enhanced bidding tools that continue to gain traction among large advertisers.

Analysts see the move as both a technical and fundamental win, unlocking a wave of institutional buying while reinforcing confidence in the company’s long-term ad stack innovation.

Shares of TTD are now up 34% in the past month and holding above their 50-day average, with upside potential into the mid-$80s as index flows continue through July 18.

Pharmaceuticals

📈 J&J Climbs After Q2 Beat and Upgraded Guidance

Image source: Reuters

Johnson & Johnson (JNJ) rose 2.4% in pre-market trading to ~$155.17 on Wednesday following a Q2 earnings beat and an upward revision to its full-year forecast.

The healthcare giant reported adjusted EPS of $2.77 versus $2.68 expected, with strong pharmaceutical sales—particularly oncology drug Darzalex—offsetting softness in the consumer health division. Operating margins expanded across the board, signaling improved cost discipline.

The report marks a rebound in sentiment for J&J after a choppy first half. Analysts highlighted the company’s ability to deliver amid macro uncertainty and supply chain pressures, and several raised their FY25 targets accordingly.

JNJ stock remains a defensive favorite and is testing resistance in the $155–157 range, with $160 in view if earnings momentum holds.

Political Market Moves (Sponsored)

A brand new technology is lining up to be more disruptive than the internet or even today's most advanced artificial intelligence.

Those who prepare now could see massive stock gains. Those who don't could find themselves on the wrong side of history.

🤝 FROM OUR PARTNERS

🛠️ TOOLS YOU CAN USE

🤗 AI Companions - xAI’s new Grok-powered interactive avatars

🗣️ Voxtral - Mistral’s first open-source voice model for speech understanding

📓 NotebookLM - New featured notebooks for expert advice on specific topics

📚 Claude Directory - A new directory of tools that connect to Claude

That’s a wrap for today’s pre-market dispatch.

Catch you tomorrow,

—The Future Bytes Team

P.S. You can unsubscribe anytime. But we hope you don’t.

This newsletter is free (for early subscribers). Enjoy!

Forwarded by a friend? Sign up with just one click here.

P.S. Make sure to whitelist our email address to ensure you never miss an update from us.