👋 Good afternoon. Wall Street kicked off July with a mixed bag: the Dow roared higher, while tech and crypto lost steam. A fiscal bombshell out of Washington, cooling AI enthusiasm, and signs of rotation into value all shaped the day’s action.

📊 MARKETS

*Stock data as of market close, cryptocurrency data as of 4:00pm ET.

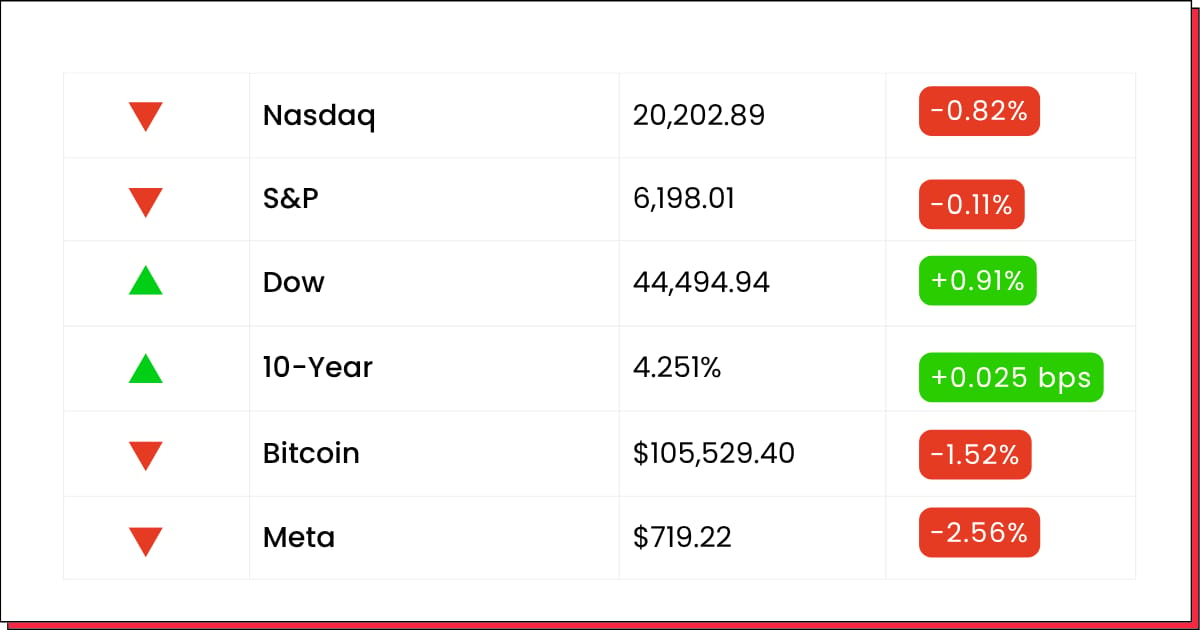

Markets: Stocks ended the first trading day of July with mixed signals. The Dow surged 0.91%, driven by strength in financials and industrials, while the Nasdaq and S&P 500 slipped 0.82% and 0.11% respectively, as tech stocks cooled off.

Meta led the tech drag, falling 2.56%, while Bitcoin slid 1.52%, snapping a recent rally. Meanwhile, the 10-Year Treasury yield ticked slightly higher to 4.251%, suggesting continued caution around inflation and upcoming economic data.

Despite the dip in risk assets like crypto and growth tech, the market's breadth remains stable with rotation into value and defensive sectors.

🔥 TRENDING

The Republican-controlled Senate narrowly approved an expansive tax-cut and spending package, dubbed the "big, beautiful bill," in a 51–50 vote (Vice President Vance breaking the tie). The measure preserves 2017 tax cuts, expands military and border spending, and is projected to add ~$800 B to the deficit compared to the House version. Markets reacted calmly, but strategists warn about longer-term pressure on bond yields and equity valuations if investor tolerance for escalating debt wanes.

Fed Chair Powell reminded investors that interest-rate cuts hinge on inflation data, particularly in light of tariff-driven inflation risks. The Fed showed no urgency to lower rates despite investor hopes for a July cut.

The S&P 500’s 50-day moving average rose above its 200-day average—the first “golden cross” since February 2023—suggesting a potential ~10% gain over the next 12 months. Bullish momentum is broadening, particularly across small- and mid-caps

High-profile tech stocks slipped. Tesla dropped ~5%, weighed down by the policy feud and sales softness in Sweden and Denmark. Nvidia declined ~2.1%, pressured by trade concerns. Other sectors like casinos and staples helped stabilize the broader market.

🧠 DEEP DIVE

Financials

📉 Goldman Sachs Edges Lower Despite Stress Test Strength

Image source: Barchart.com

Goldman Sachs (GS) slipped -0.18% to close at $706.41 on Tuesday, despite headlines praising the bank’s performance in the Federal Reserve’s latest stress tests.

The minor dip comes as investors weigh the broader implications of the Fed’s cautious stance on rate cuts and capital distribution. Goldman was among the top Dow drivers earlier in the session before trimming gains late in the day.

With regulators giving the green light, the bank is expected to ramp up share buybacks and dividend increases in the coming quarter—a bullish signal for shareholders.

Analysts view Goldman as well-positioned among large banks, especially as capital return plans take shape. Still, macroeconomic uncertainty and political headwinds could keep financial stocks rangebound in the near term.

Goldman shares are up roughly 9% over the past three months and continue to trade near multi-month highs.

Casinos & Gaming

🎰 Wynn Surges as Macau Tourism Sparks Gambling Rebound

Image source: Wynn

Wynn Resorts (WYNN) rallied 8.4% to close at $101.56 on Tuesday, driven by upbeat June casino revenue out of Macau that signaled a full-fledged recovery in Asia’s gambling hub.

Macau gaming revenue rose 19% year over year, with a notable 11% jump in tourist arrivals fueling hotel bookings and high-roller activity. The momentum helped lift shares of major casino operators, with Wynn among the top gainers.

The luxury resort operator is riding a rebound in Chinese tourism while benefiting from a high-margin recovery in VIP segments and retail traffic.

Analysts expect continued upside if trends hold, though geopolitical tension and Chinese regulatory unpredictability remain key risks.

Wynn stock is now up more than 25% from its May lows and is closing in on resistance near the $105–$110 zone.

Semiconductors

🚀 Wolfspeed Skyrockets After Chapter 11 Restructuring Plan

Image source: Investopedia

Wolfspeed (WOLF) soared 111% to $0.85 on Tuesday after announcing a pre-packaged Chapter 11 bankruptcy aimed at cutting debt and restructuring its capital base.

The silicon carbide chipmaker said it had secured creditor backing to reduce its debt load by roughly $4.6 billion, with operations expected to continue without interruption during the process.

Investors viewed the filing as a positive reset after months of cash burn and balance sheet deterioration. The move gives Wolfspeed a chance to clean up its financials and refocus on next-gen chip production.

While speculative, the bounce shows investor appetite for turnaround plays in the semiconductor sector—especially amid growing demand for EV and energy-efficient chips.

WOLF stock remains down sharply YTD but could see further volatility as it works through bankruptcy court approvals.

Crypto & Fintech

🪙 Coinbase Dips as Sector Rotation Favors Rivals

Image source: Blockworks

Coinbase (COIN) dropped 4.1% to $335.95 on Tuesday, slipping as traders rotated out of established crypto platforms following Robinhood’s aggressive expansion into tokenized equities and derivatives.

The move came despite continued strength in the broader digital asset market, with Bitcoin hovering near recent highs. Analysts cited investor enthusiasm around innovation and lower fees on competing platforms as short-term pressures on COIN.

Still, Coinbase remains a dominant player in the U.S. crypto trading space, with a robust product pipeline and institutional trust unmatched by newer entrants.

Analysts at JMP and Needham maintain “Outperform” ratings, but warn that competition and regulatory uncertainty could weigh on short-term momentum.

Coinbase shares are still up over 90% year-to-date, but now face resistance at the $350 level.

📊 WINNERS & LOSERS

📈 Top Gainers

Wolfspeed (WOLF). +111% — Shares exploded after announcing a pre-packaged Chapter 11 restructuring plan to slash $4.6 billion in debt, with creditors on board and operations continuing during bankruptcy.

Las Vegas Sands (LVS). +9.1% — Jumped on surging Macau gaming revenue (+19% YoY), with rising tourist foot traffic and renewed investor interest in Asian casino operators.

Wynn Resorts (WYNN). +8.4% — Rose alongside LVS after strong June Macau numbers signaled a robust recovery in high-end tourism and gaming activity across Asia.

Hasbro (HAS). +3.5% — Gained after Goldman Sachs upgraded the stock, citing strong growth in its "Magic: The Gathering" franchise and positive momentum in digital licensing and gaming segments.

Packaging Corp of America (PKG). +4.3% — Advanced after acquiring a major containerboard business from Greif, reinforcing its leadership in the U.S. packaging industry and boosting its production footprint.

📉 Notable Decliners

Progress Software (PRGS). −12% — Fell sharply after missing revenue estimates for the quarter, despite beating on earnings. Investors reacted to soft forward guidance and tightening budgets in enterprise IT.

Coinbase (COIN). −4.1% — Pulled back as investor attention shifted to Robinhood’s crypto and tokenized equity rollout, raising concerns over competitive pressure despite strong fundamentals.

AeroVironment (AVAV). −5.5% — Dropped after announcing a $1.35 billion stock and convertible note offering to fund its $4.1 billion acquisition of BlueHalo, raising dilution and leverage concerns.

Sweetgreen (SG). −4% — Slipped after a TD Cowen downgrade pointed to softer urban dine-in traffic and slower-than-expected traction for new menu rollouts.

Tesla (TSLA). −5% — Slid further amid political tension between Elon Musk and President Trump over EV subsidies, with additional pressure from weakening European sales.

That’s all for today.

Markets may be starting the month unevenly, but volatility = opportunity.

Stay sharp, stay informed and keep your eye on the rotation.

Catch you tomorrow morning with pre-market action and early movers,

—The Future Bytes Team

This newsletter is free (for early subscribers). Enjoy!

Forwarded by a friend? Sign up with just one click here.

P.S. Make sure to whitelist our email address to ensure you never miss an update from us.