⛅ Good morning. The rally that no one saw coming keeps raging. Despite warnings of tariffs, inflation stickiness, and political chaos, the S&P just clocked another record close. With IPOs heating up, M&A back in vogue, and jobs data on deck this week… let’s dive in.

📊 MARKETS

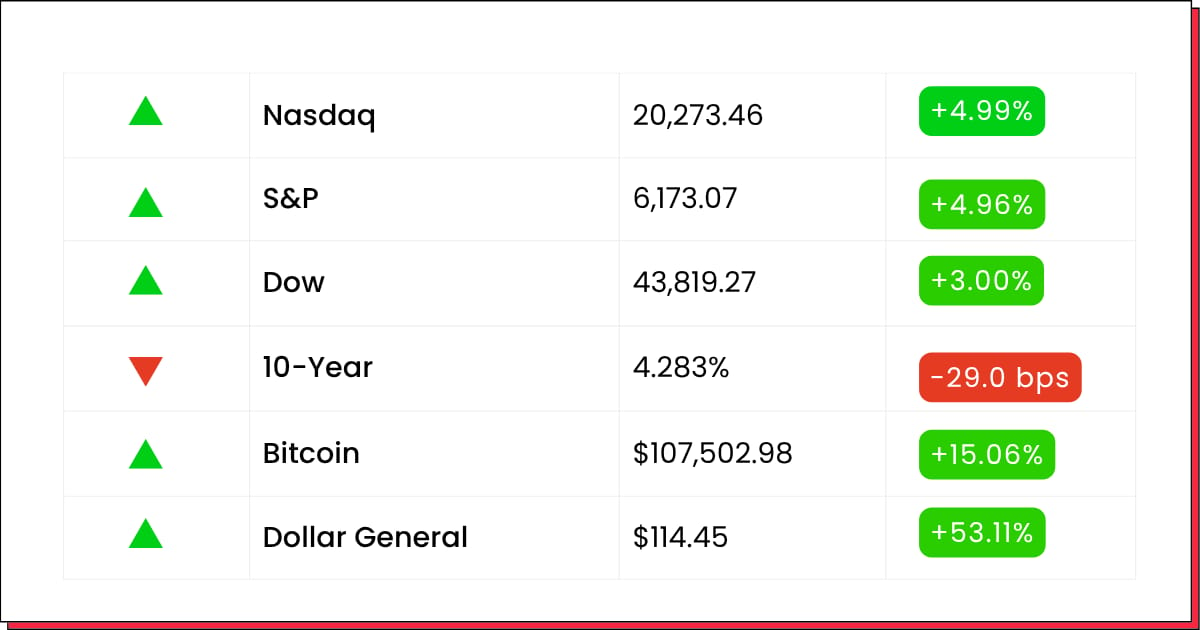

*Stock data as of market close, cryptocurrency data as of 2:00pm ET.

Markets: The S&P 500 is kicking off the shortened trading week at a record high—something few saw coming after it sank 19% from February’s peak to an April low. What’s more surprising? This rally isn’t just about Big Tech. Dollar General, for example, has soared nearly 50% since February and now holds the title of top S&P performer in that stretch.

📈 PRE- MARKET REPORT

Futures are pointing higher this morning: Dow +0.5%, S&P 500 +0.4%, Nasdaq 100 +0.6%, as optimism grows around trade and M&A headlines

🔎 Premarket Highlights

Technical outlook: Fair opening near $22.26, with resistance around $22.60–22.95; support near $21.37–21.92 . Composite ratings recently elevated to 96, signaling institutional confidence

Tactical note: BE’s rally is tied to clean-tech flow and margin recovery. Ahead of jobs data, keep exposure light—use dips toward $21.70 as potential buy zones, with stops under $21.30 for a defensive swing.

Our Take: Clean-energy momentum is returning, BE could hold gains if broader sentiment remains strong.

🚀 Lockheed Martin (LMT). Lockheed Martin is drawing fresh investor attention amid renewed geopolitical tensions and ongoing U.S. defense policy shifts. With President Trump’s “rapid-fire policymaking” causing volatility in market sentiment, LMT offers a relative safe haven in the large-cap defense space.

Technically, LMT pulled back to its 200‑day moving average near $500 and is showing a potential bounce.

Lockheed Martin Slides Despite Policy Tailwinds

Lockheed Martin (LMT) slipped 1.2% on Friday, capping a volatile week for defense names amid shifting policy signals from Washington and rising global security spending.

The defense giant continues to benefit from record Pentagon budgets and increased NATO procurement, with a backlog exceeding $160 billion. However, recent comments from former President Trump—hinting at possible NATO payment restructuring—sparked a wave of defensive profit-taking.

Investors appear torn between long-term growth from missile systems and aerospace contracts, and near-term political uncertainty heading into the U.S. election cycle.

LMT is also facing margin pressure in its Aeronautics segment due to supply chain bottlenecks and rising input costs, which management says could normalize by Q4.

Despite the pullback, analysts remain optimistic, with Citi and Goldman Sachs reaffirming Buy ratings and raising 12-month price targets to $520, citing strong international demand and next-gen defense tech.

Shares are down ~4% over the past month, currently trading around $498.

Tactical note: Consider a tactical entry on dips toward $500 with tight stops below $490, as Lockheed remains one of the favored large-cap plays if policy uncertainty persists.

🔗 HPE – Hewlett Packard Enterprise (HPE) & JNPR – Juniper Networks (JNPR). HPE and Juniper reached a settlement with the U.S. Department of Justice on June 28, removing a major roadblock to their $14 billion merger.

As part of the agreement, HPE will divest its Instant On WLAN business and license Juniper’s Mist AI software to competitors, laying the groundwork for DOJ approval by auctioning Mist AIOps source code

Deal rationale: The merger doubles HPE’s networking capabilities and positions the company as a stronger contender against Cisco in AI‑centric, hybrid cloud and edge infrastructure . HPE CEO Antonio Neri emphasized the strategic goal to “provide customers with a modern network architecture alternative” tailored for AI workloads

Tactical note:

Near-term pullback trade: Shares may retrace slightly on deal-related uncertainty (instant-on divestiture, licensing timelines). A pullback toward $14.50–15.00 (for HPE) could offer a low-risk entry ahead of merger close.

Zoom-out structural play: Post-close, the combined firm may see margin expansion and re-rating as synergies from Mist AI investments come online. A long-term position could target $18–20 if regulatory integration proceeds smoothly.

Our Take: A clear win for enterprise IT M&A, watch for follow-through in networking and cloud infrastructure names.

⚠️ CRCL – Circle Internet Group. CRCL stock surged over 160% from its IPO price of $31, peaking near $300, before tumbling ~25% mid-June on profit-taking and valuation concerns ($42B market cap vs $1.7B 2024 revenue).

Analysts remain divided: Barclays, Bernstein, Canaccord, and Needham initiated coverage with “buy” and targets above $200, citing strong regulatory momentum (GENIUS Act), , while J.P. Morgan and Goldman rated it underweight/neutral with targets near $80–83, warning of elevated valuation.

Risks on the radar:

Ongoing volatility tied to crypto market sentiment.

Regulatory tug-of-war: GENIUS Act passage vs looming restrictions under the STABLE Act on interest-bearing stablecoins

Heavy dependency on USDC issuance and Coinbase partnership (paid $908M in 2024)

Tactical note:

On weakness post-earnings or regulatory news, dip-buy around $180–200 could capture a rebound backed by bullish analyst coverage, with stops near $160.

More conservative traders might wait for stabilization below $150 before scaling in, especially given valuation mistrust.

Our Take: Remains a volatile spec play; traders may watch for short-covers or bounce setups, but caution is warranted.

🔥 PRGS – Progress Software (PRGS). PRGS is poised for its Q2 release after markets close June 30. Q1 revenue rose 29% Y/Y to $238 M, ARR up 48% to $836 M, helped by its ShareFile acquisition. Consensus Q2 expects $237.5 M revenue (+36%) and $1.30 EPS (+19%)

Analyst view: Seen near breakout at $64.84, with a Buy consensus and ~$76 target—a ~19% upside .

Tactical note: A beat/guidance raise post‑jobs could spark a breakout. Consider call options or small long positions; if jobs disappoint and broader market dips, PRGS might pull back to $60–62 support.

Our Take: Strong AI‑inflected growth baked in, a beat could drive another leg of upside, but watch guidance.

💾 Micron Technology (MU). Micron shares jumped this week after upbeat AI-related demand commentary, helping sustain the tech rally. March-quarter earnings beat expectations, and analysts are forecasting strong growth as AI adoption accelerates.

Micron Gains as AI Memory Demand Powers Forecast Upgrade

Micron Technology (MU) climbed 3.8% last week after raising guidance and reporting surging demand for high-bandwidth memory (HBM) used in AI accelerators.

The chipmaker posted fiscal Q3 revenue of $6.8 billion, up 81% year over year, fueled by a sharp recovery in DRAM pricing and early shipments of HBM3E chips bound for Nvidia’s data center platforms.

Adjusted EPS came in at $0.62, crushing the $0.49 consensus estimate. Gross margins expanded to 28.5%—a major reversal from the negative margins seen a year prior.

Management lifted its Q4 revenue forecast to between $7.4 and $7.8 billion and said it expects AI-related memory to make up over 40% of total DRAM revenue by mid-2026.

Still, analysts caution that broader weakness in consumer electronics and hyperscaler pricing pressures could create pockets of volatility.

Micron is up 58% YTD, with shares hovering just below $130 and within striking distance of their all-time high.

Tactical note: Use any short-term pullback toward the $95–$100 range as a potential entry before the jobs release. Upside catalyst remains clear—continued AI momentum.

🌍 Major Indices

📈 S&P 500 Climbs to Record Close Amid Tariff Relief & Strong Earnings

U.S. equities pushed higher this week, with the S&P 500 closing at a record 6,173.07 on June 27. Investors embraced cooling tariff tensions after the rollback of some “Liberation Day” levies, alongside strong Q1 earnings—S&P 500 profits jumped ~13.7% Y/Y, well outpacing expectations. A retreat in volatility (VIX near long-term average ~16) confirmed the buying momentum.

Economic Data & Fed Outlook

💸 Focus Turns to June Jobs Report and July Tariff Deadline

With geopolitical noise easing, market attention shifts to June’s nonfarm payrolls due this Thursday and the looming July 9 tariff hike deadline. Economists expect ~129K jobs added. The data will heavily influence Fed timing on rate cuts, especially as some officials warn tariffs could add inflationary pressure .

Sector Rotation & Macro Trends

🪙 Flows Shift From Mega‑Cap Tech Toward Cyclicals, Gold, Defense

Beyond the “Magnificent Seven” leading the rally, investors are rotating into industries like defense, mining, gold, and European industrials. A softer dollar and U.S. debt concerns have triggered a broadening market bid, even as Chinese tech shows stronger performance YTD

⚡ QUICK BYTES

🆕 NIQ Global files for U.S. IPO. Nielsen spin-off NIQ, backed by Advent & KKR, just filed to go public on the NYSE. With ~$966M Q1 revenue and cutting losses nearly in half, the move highlights renewed investor appetite for data plays

📚 McGraw Hill tables U.S. IPO. The textbook publisher filed for a U.S. IPO, reporting $2.1B in annual revenue and a tightened net loss of $86M—a sign the education sector is tapping public markets

💼 Jefferson Capital raises $150M. Private equity-backed Jefferson Capital returned to Nasdaq, raising $150M in its IPO after pricing shares at the low end of the range

💰 Global M&A rebounds in H1. Megadeals are back on bankers’ radars—with Asia leading the charge. Despite policy uncertainty, dealmakers expect a surge in second-half M&A activity

💰 MARKET MOVES

🔹GMS (GMS): +11% pre‑market. Building-products distributor GMS surged sharply after Home Depot’s subsidiary SRS agreed to acquire it for roughly $5.5B, drawing investor excitement on consolidation in the sector.

🔹 Juniper Networks (JNPR): +8.5% pre‑market. Juniper climbed following DOJ clearance of its $14B sale to Hewlett Packard Enterprise—removing regulatory uncertainty and fueling a healthy merger bounce.

🔹 First Solar (FSLR): +7.6% pre‑market. Solar-panel manufacturer First Solar rallied as U.S. Senate momentum on clean-energy support boosted investor sentiment toward domestic green infrastructure.

🔹 Tesla (TSLA): –0.7% pre‑market. Tesla slipped amid concerns that new legislation could eliminate EV tax credits by September—raising questions about near-term sales support.+

🔹 Wells Fargo (WFC) & Goldman Sachs (GS): +1–2% pre‑market. Both banks edged higher after releasing their Fed stress-test results, suggesting stronger capital positions and paving the way for potential buybacks or dividend boosts

🛠️ TOOLS YOU CAN USE

⚙️ Gemma 3n: Open models with multimodal capabilities for edge devices

🎨 Flux 1 Kontext [dev]: Open-weight, SOTA image editing model

👗 Doppl: Create AI-generated try-on videos from a photo and product

🤝 Coachvox: Clone an AI version of yourself to coach clients in your style

🧩 Everything Else

🚨 BP’s pivot fizzles . Weak performance sparks buyout rumors after strategy shift backfires.

📱 TikTok takeover? Trump says investor group is ready to swoop in as U.S. ban nears.

⚡ Ford flags EV threat. Warns China’s electric vehicle dominance is a major risk to U.S. automakers.

💼 Trade tensions rise. Trump sticks to July 9 tariff deadline; Canada scraps digital tax in response.

📉 $28B stock selloff incoming. Goldman says U.S. pension funds will rebalance at month-end.

🔍 Boeing under scrutiny. U.K. regulators open antitrust probe into Spirit AeroSystems deal.

The markets don’t sleep, and neither do we (kind of).

Catch you tomorrow—same time, sharper moves.

—The Future Bytes Team

P.S. You can unsubscribe anytime. But we hope you don’t.

This newsletter is free (for early subscribers). Enjoy!

Forwarded by a friend? Sign up with just one click here.

P.S. Make sure to whitelist our email address to ensure you never miss an update from us.