⛅ Good morning. July kicks off with a swirl of headlines: Trump’s “big, beautiful” tax bill gets the Senate’s green light, bank stocks pop on Fed-approved buybacks, and Tesla stumbles after a rough delivery report.

But the real plot twist? Wolfspeed doubled in a day, yes, +111%, this is after filing for bankruptcy.

Elsewhere, Verint surged on buyout buzz, Centene cratered on a guidance shock, and First Solar lit up the board on green-energy tailwinds.

Meanwhile, traders are bracing for key jobs data, tariff noise, and more volatility as Q3 begins.

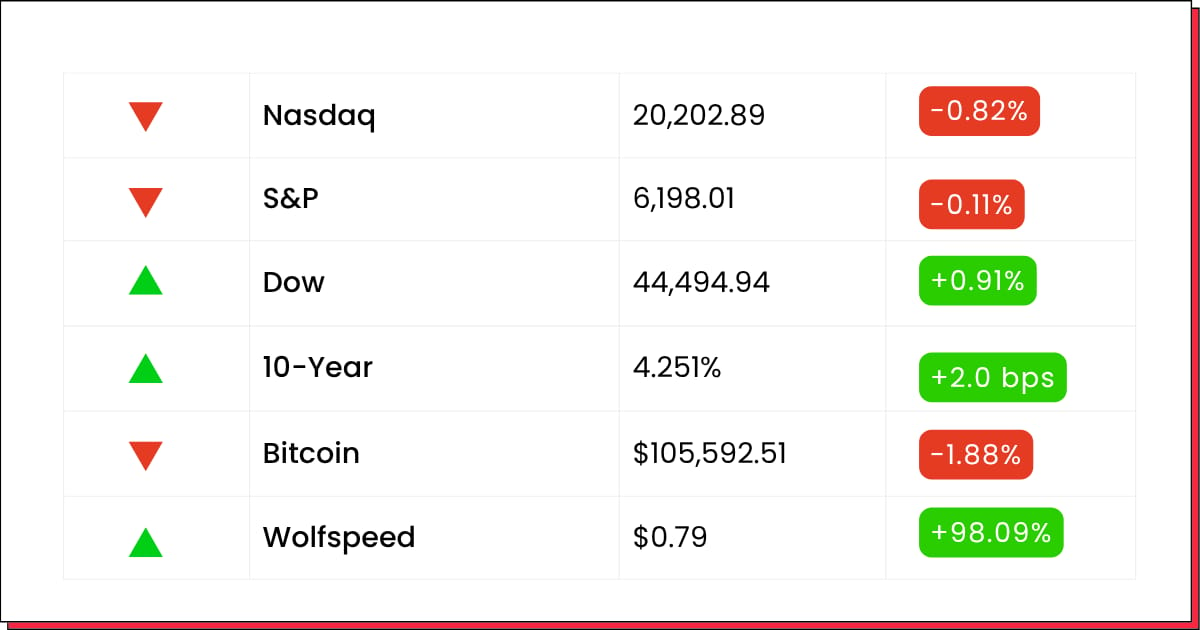

📊 MARKETS

*Stock data as of market close, cryptocurrency data as of 4:00pm ET.

Markets: Stocks inched lower yesterday as the Senate greenlit President Trump’s sweeping tax package (more on that below). While Wolfspeed pulled a plot twist, shares nearly doubled after a bankruptcy filing, though the stock is still down about 90% year to date..

📈 PRE- MARKET REPORT

Markets

U.S. futures are modestly higher ahead of today’s open: Dow +0.21%, S&P 500 +0.13%, Nasdaq +0.14%, while VIX futures dip ~0.4%, signaling a calmer tone as markets await softening trade headlines and initial ADP jobs data

🏦 Financials

JPM, BAC, WFC, C

What’s up: Bank futures are lifting slightly after the Fed greenlit a $50B buyback boost and dividend hike from major banks .

Our Take: If yields remain firm and tech lags, financials might lead again,look for dips near 21‑day averages as entry.

🏥 Healthcare

Centene (CNC) & Oscar Health (OSCR)

What’s up: Centene futures sank ~29%, Oscar -10.6%, following Centene’s earnings guidance withdrawal .

Our Take: These stocks could bounce if management regains confidence, but expect steep volatility, avoid until clarity returns.

🔐 Crypto / Digital Assets

Galaxy Digital (GLXY) & MicroStrategy (MSTR)

What’s up: GLXY +3%, MSTR +2.7% pre-market on firmer Bitcoin (~2.3%) .

Our Take: If crypto holds, these play catch-up tech trades, just size positions tight given overnight risk.

🛢️ Commodities

Oil: Brent crude futures +1.4%; Gold: +0.12%

Treasury: 10‑Year yield edges up to ~4.29%

Our Take: Hard assets reflect inflation policy watch, keep an eye on yields and gold for shifting sentiment cues.

📊 Macro

Trade & Jobs on Deck

Markets are digesting a continuation of trade tension as the July 9 tariff deadline nears. ADP private payrolls—which could print around 99K—are due at 8:15 a.m. ET; EIA crude inventories follow at 10:30 a.m. ET

👀 What to Watch: Shipping headlines (India, Japan, Canada), ADP deviation from ~105K, crude flows—these can trigger intra-day rotation.

🧠 DEEP DIVE

Electric Vehicles

📉 Tesla Drops as Delivery Miss and Musk Comments Weigh on Shares

Image source: AOL

Tesla (TSLA) fell 5.38% to close at $300.71 on Wednesday after investors reacted to soft Q2 delivery figures and lingering political tension between CEO Elon Musk and President Trump over EV subsidies.

The company reported just 355,000 vehicle deliveries in Q2, down nearly 20% from the prior year and well below Wall Street expectations. Regional weakness, particularly in Europe and China, further pressured sentiment—deliveries in Sweden and Denmark declined for a sixth consecutive month.

Musk’s recent comments criticizing the current administration’s subsidy policies have also added uncertainty as Tesla navigates political crosscurrents heading into the November election.

Despite near-term headwinds, analysts at Morgan Stanley and Bernstein maintain an Overweight rating, citing Dojo’s long-term AI potential and the company’s growing software revenue base.

Tesla shares are now down more than 25% from their 2025 high, currently trading near a key support zone around $300.

Banking

Image source: WSJ

JPMorgan Chase (JPM) inched up 0.17% to close at $290.41 on Wednesday after confirming a robust $50 billion share repurchase plan and lifting its quarterly dividend to $1.50 per share.

The announcement followed the bank’s clean sweep of the Federal Reserve’s latest stress tests, which affirmed its strong capital position and gave the green light for enhanced capital returns.

CEO Jamie Dimon emphasized the firm’s “fortress balance sheet” and commitment to long-term shareholders, while analysts praised JPMorgan’s ability to grow earnings and return capital even in a higher-rate environment.

With dividend yields now approaching 2%, JPMorgan is drawing interest from income-focused investors seeking quality exposure in a market shifting away from tech.

Shares are up 12% year-to-date and are trading just shy of their 2025 high near the $295 resistance level.

Software & M&A

🤝 Verint Surges on Reports of Thoma Bravo Buyout Talks

Image source: Demandteq

Verint Systems (VRNT) jumped 13% to close at $18.59 on Wednesday following reports that private equity giant Thoma Bravo is in advanced talks to acquire the company.

The rumored deal would mark another high-profile move by Thoma Bravo in the cybersecurity and enterprise software space, where it’s been aggressively consolidating AI-powered platforms in recent years.

Investors welcomed the news as a potential lifeline for Verint, which has struggled to regain momentum in the face of increasing competition. Analysts estimate a takeover could value the company between $24 and $28 per share.

While the company declined to comment, the stock surged on heavy volume and remains a top event-driven trade heading into Q3.

Verint shares are up over 30% in the past five sessions and are now trading at their highest level since February.

🧩 EVERYTHING ELSE

Centene plunged ~27% after pulling its full-year guidance, rattling broader health insurance names

Constellation Brands falls 0.8% despite earnings beat, with Investors citing softness in beer sales amid weaker consumer demand .

Adobe dropped 1.4% on reduced outlook and competitive headwinds from Figma’s impending IPO

Greenbrier +15% following strong earnings beat and margin guidance lift

Macro focus remains on ADP jobs data and non-farm payrolls, as well as potential tariff actions, Fed direction, and Powell’s potential replacement by Trump

💰 MARKET MOVES

🔹Centene (CNC): –26.6% pre‑market. Shares plunged after the insurer abruptly withdrew its full-year guidance amid soft marketplace revenue—dragging peers like Elevance and UnitedHealth along for the ride

🔹 Apple (AAPL): +0.7% pre‑market. Apple edged higher following a Jefferies upgrade to "Hold," driven by optimism on June-quarter results

🔹 First Solar (FSLR) / Enphase Energy (ENPH): +3.0–3.2% pre‑market. Solar stocks rallied after the Senate removed a renewable-energy excise tax—providing a fresh tailwind for clean-energy plays

🔹 Oscar Health (OSCR): –10.6% pre‑market. Digital health insurer tumbled after pulling guidance amid rising cost concerns ahead of the earnings call

🔹 MicroStrategy (MSTR): +2.7% pre‑market. Bitcoin-fueled rally continues as crypto holdings push MicroStrategy higher, amid resumed risk-on flows and strong bitcoin performance

🛠️ TOOLS YOU CAN USE

🤖 Ernie 4.5: Baidu’s latest open-source family of advanced AI models

🧬 Chai-2: AI capable of creating functional antibodies for drug development

⚙️ Cursor Agents: Work with a powerful coding assistant on browser & mobile

📝 Co-STORM: Write Wikipedia-like articles from scratch based on AI search

That’s a wrap for this morning’s bites.

With macro risk swirling from tariffs to jobs data and Q3 earnings just around the corner, expect volatility to stay elevated.

We'll be back with more insights and stock spotlights as the stories unfold,

—The Future Bytes Team

P.S. You can unsubscribe anytime. But we hope you don’t.

This newsletter is free (for early subscribers). Enjoy!

Forwarded by a friend? Sign up with just one click here.

P.S. Make sure to whitelist our email address to ensure you never miss an update from us.